The Green New Deal would be the most extensive exercise in “Broken Window Economics” in the history of the globe. The “Green New Deal” would cause massive deadweight losses in virtually every sector of the US economy, while producing no measurable impact on global climate.

“Deadweight loss can be stated as the loss of total welfare or the social surplus due to reasons like taxes or subsidies, price ceilings or floors, externalities and monopoly pricing. It is the excess burden created due to loss of benefit to the participants in trade which are individuals as consumers, producers or the government.” (The Economic Times)

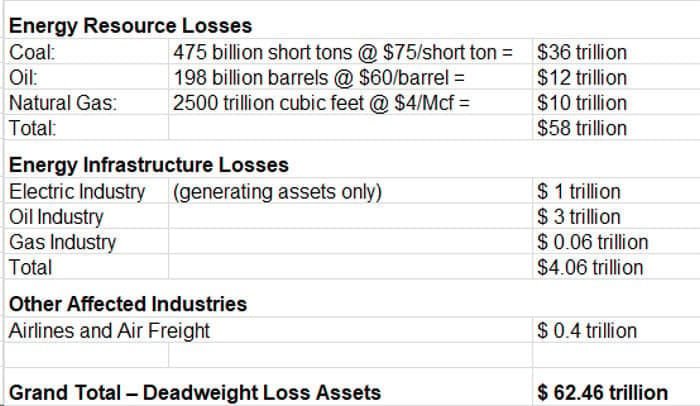

The following is a list of key industries affected by the climate change aspects of the “Green New Deal”. However, all US economic activity would be affected to some extent, so the total affects are likely significantly understated.

Obviously, the major financial impact is the result of the plan to leave the US substantial energy resources “in the ground”, as has been advocated by numerous environmental groups previously.

The impact of the plan to render air travel obsolete, combined with the intent to halt the production of the fuels required by the airline and air freight industries would expand well beyond the US. Air service to and from the US to other locations would also be impacted, since refueling would not be available in US. International air operations would require that the aircraft carry sufficient fuel for a round trip or add a refueling stop in some country which still permitted production and sale of aviation fuels.

The impact of terminating fossil-fueled electric generation and not only replacing the existing generating capacity but also adding sufficient capacity to power the replacements for direct-fired residential, commercial and industrial energy end uses would be profound. The electric energy required to meet all current electric end use consumption plus the direct end uses currently served by oil and natural gas and their derivatives would be approximately three times the quantity of energy currently provided by existing electric generators. Also, the intermittent nature of current renewable energy systems would require that the installed renewable generating capacity per unit of electric energy consumption be approximately three times the generating capacity of the fossil-fueled generating capacity it replaced; and, that the renewable generating capacity be supported by long duration, transmission-level storage capacity.

Current US electricity production is approximately 4 trillion kWh per year, of which approximately 2.5 trillion kWh is produced using fossil fuels and 0.8 trillion kWh using nuclear generators. Increasing US electricity production to approximately 12 trillion kwh per year would require increasing the current wind and solar electricity production from its current approximately 0.3 trillion kWh per year, or by a factor of approximately 40.

Current US electric generating capacity is approximately 1,000 GW, of which approximately 750 GW is fossil fueled. Replacing this dispatchable fossil fueled generating capacity with a mix of intermittent clean and renewable generation with an average availability of approximately 25-30% would require the installation of approximately 2000 GW of new generating capacity, plus the storage capacity necessary to assure reliable service. US EIA has estimated the cost of installing new solar photovoltaic generating capacity at approximately $3,700 per kW and new wind generating capacity at approximately $1,900 per kW. Assuming an average of $2,800 per kW of clean and renewable generating capacity, the installed cost of 2000 GW of new capacity would be approximately $5.6 trillion.

A trillion here, a trillion there and pretty soon you’re talking about real money.

(with apologies to the late US Senator Everett McKinley Dirksen , R, IL)

- Deadweight Loss